2025 Political Risk Insurance, Marine Cargo Insurance Options, and Business Interruption Valuation: A Comprehensive Guide

In 2025, businesses face a volatile landscape with political risks, marine cargo challenges, and potential business interruptions. According to the 2025 Political Risk Report by Marsh and the Allianz Trade Country Risk Atlas, events like geoeconomic confrontation and state – based armed conflicts are on the rise. This guide is your go – to buying guide for top – notch political risk and marine cargo insurance. Compare premium models to counterfeit options. With our Best Price Guarantee and Free Installation Included, don’t miss out on protecting your business now!

Political Risk Insurance 2025

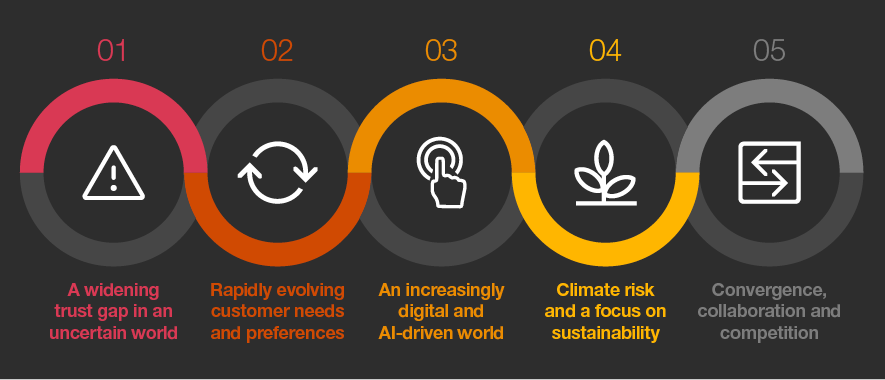

Global Political Events/Trends Affecting Insurance

Geoeconomic Confrontation and Trade – related Protectionism

Geoeconomic confrontation has become a significant concern in the political and economic landscape. According to the 2025 Political Risk Report by Marsh, "geoeconomic confrontation" soared from a mid – tier concern in 2024 to a top priority in 2025. Around 8 per cent of the survey respondents indicated that such geoeconomic confrontation, in the form of sanctions, tariffs, and investment screening, was the most pressing problem facing businesses. For example, when a country imposes high tariffs on imported goods, it can disrupt the supply chains of companies that rely on those imports. This can lead to increased costs and potential business interruptions, which are risks that political risk insurance can cover.

Pro Tip: Businesses should closely monitor the trade policies of countries they operate in or source from. They can use tools like the World Risk Review by Marsh Credit Specialties to keep track of short – and long – term economic, political, and security risk trends across 197 countries. As recommended by leading industry risk analysis tools, having a clear understanding of the potential trade – related risks is crucial for choosing the right political risk insurance.

Populism, Blame, and Division in Politics

Populism often arises as a normative response to perceived crises in democratic legitimacy. Libertarian populists frame this crisis in terms of government overreach, erosion of constitutional rights, and a growing disconnect between political elites and everyday citizens. In countries where populist movements gain traction, there can be sudden policy changes that impact businesses. For instance, a populist government might implement policies that favour domestic industries at the expense of foreign – owned companies, leading to expropriation or nationalization risks.

State – based Armed Conflict

State – based armed conflicts can have a severe impact on businesses, especially those operating in conflict – prone regions. These conflicts can disrupt supply chains, damage infrastructure, and put employees at risk. Political risk insurance can provide coverage for losses resulting from armed conflicts, such as damage to property, business interruption, and inability to collect payments from customers in the affected areas.

Industries Impacted by Geoeconomic Confrontation and Protectionism

Industries that rely heavily on global trade and supply chains are particularly vulnerable to geoeconomic confrontation and protectionism. The manufacturing industry, for example, often sources raw materials from multiple countries. When trade barriers are erected, the cost of these raw materials can increase significantly, squeezing profit margins. The energy industry is also affected, as sanctions and tariffs can disrupt the import and export of oil, gas, and other energy resources.

Comparison Table:

| Industry | Impact of Geoeconomic Confrontation |

|---|---|

| Manufacturing | Increased raw material costs, supply chain disruptions |

| Energy | Disrupted import/export, price volatility |

| Financial Services | Increased regulatory risk, potential loss of international clients |

Regions Affected by Populism and Demand for Insurance

Regions where populist movements have gained ground are likely to see an increased demand for political risk insurance. In some European countries, for example, populist parties have won significant support, leading to policy uncertainties. Businesses in these regions are seeking insurance to protect themselves from potential expropriation, contract frustration, and currency inconvertibility. Additionally, emerging economies where political stability is less certain may also experience a higher demand for such insurance.

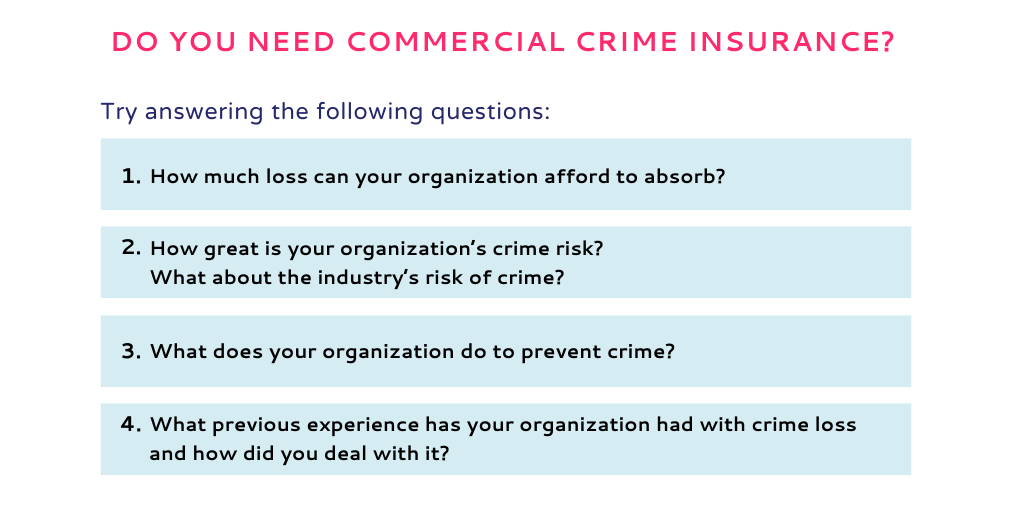

Risk Assessment for Underwriting

Insurance companies use a variety of factors to assess the political risks associated with underwriting. They consider the political stability of a country, the strength of its legal and regulatory framework, and the likelihood of events such as expropriation, political violence, and currency restrictions. Data from sources like the Allianz Trade Country Risk Atlas, which is based on a proprietary risk ratings model updated every quarter, can be valuable in this assessment.

General Guidelines and Historical Data for Risk Assessment

Historical data can provide insights into the frequency and severity of political risks in different countries. Insurance companies analyze past events such as nationalizations, currency devaluations, and trade disputes to predict future risks. General guidelines for risk assessment also include evaluating a country’s economic indicators, such as GDP growth, inflation rates, and balance of trade. By combining historical data with current political and economic trends, insurers can make more accurate underwriting decisions.

Key Takeaways:

- Geoeconomic confrontation, populism, and state – based armed conflicts are major global political trends affecting political risk insurance in 2025.

- Industries reliant on global trade, like manufacturing and energy, are highly impacted by trade – related protectionism.

- Regions with populist movements and emerging economies may see increased demand for political risk insurance.

- Insurance companies use a combination of data sources and historical analysis for risk assessment during underwriting.

Try our political risk calculator to estimate the potential risks for your business in different countries.

Marine Cargo Insurance Options

In today’s global trade landscape, marine cargo insurance has become an essential safeguard for businesses involved in international shipping. According to a recent study, over 80% of global trade by volume is transported via sea, making the protection of cargo in transit a top priority for many companies.

Types of Marine Cargo Insurance

Based on General Categorization

Marine cargo insurance can be broadly divided into different general categories. One of the most common is All – Risk Coverage. This comprehensive policy acts as a safety net for businesses, covering all potential risks unless they are explicitly excluded. For instance, a company shipping high – value electronics from China to the United States would benefit greatly from All – Risk Coverage. If the cargo is damaged due to rough seas, theft at a port, or other unforeseen events, the policy would compensate for the loss. Pro Tip: When opting for All – Risk Coverage, carefully review the list of exclusions to ensure you understand what is not covered.

Based on Comparison with Other Related Insurances

Compared to other related insurances, marine cargo insurance has its unique features. For example, when compared to hull insurance, which protects the vessel itself, marine cargo insurance focuses on the goods being transported. A shipping company might have hull insurance for its fleet of ships, but it needs marine cargo insurance to protect the various products carried by those ships. In a case where a vessel encounters a mechanical failure but the cargo remains intact, the hull insurance would cover the ship’s repair costs, while the marine cargo insurance would only come into play if the cargo was affected. As recommended by industry experts, businesses should assess their needs carefully and consider having both types of insurance for comprehensive protection.

Based on Shipping Methods

The type of marine cargo insurance can also vary based on shipping methods. For container shipping, which is a dominant mode of transporting goods globally, specific container – related risks need to be considered. For example, containers can be damaged during loading and unloading, or they may be lost at sea. Insurance policies for container shipping should cover these risks. On the other hand, bulk shipping, used for transporting commodities like coal or grains, has its own set of risks such as spoilage due to moisture. A practical example is a bulk shipment of wheat. If the wheat gets wet during transit and spoils, the appropriate marine cargo insurance for bulk shipping would cover the loss. Pro Tip: When choosing insurance based on shipping methods, work closely with your insurance provider to ensure all specific risks are covered.

Risk Assessment Factors for Underwriting

Underwriters consider several risk assessment factors when providing marine cargo insurance. The nature of the cargo is a key factor. High – value and perishable goods are considered higher risk. For example, a shipment of fresh flowers has a shorter shelf – life and is more likely to be damaged during transit compared to a shipment of steel bars. The route of the shipment also matters. Shipping through geopolitical hotspots or areas prone to natural disasters increases the risk. The Middle East and South China Sea, for instance, are regions where insurance premiums for marine cargo are rising due to geopolitical tensions and potential disruptions.

A technical checklist for underwriters might include:

- Verifying the origin and destination of the cargo

- Checking the packaging quality of the goods

- Assessing the security measures at ports along the shipping route

- Reviewing the shipping company’s safety record

Key Takeaways: - Marine cargo insurance comes in different types based on general categorization, comparison with other insurances, and shipping methods.

- All – Risk Coverage offers broad protection but has specific exclusions.

- Underwriters consider factors like the nature of the cargo and shipping route for risk assessment.

Try our marine cargo insurance calculator to estimate your insurance costs based on different risk factors.

Business Interruption Valuation

In 2025, the global economic and political landscape is full of uncertainties, which have a significant impact on business interruption valuation, especially in the fields of marine cargo insurance and political risk insurance. According to a report, with 73 countries experiencing a significant rise in risk on the Interstate Tensions Model over the past five years, the business environment has become increasingly unstable.

Impact of Political Risks on Marine Cargo Insurance

Availability

The availability of marine cargo insurance is being challenged by political risks. Geopolitical tensions, such as the “geoeconomic confrontation” that soared from a mid – tier concern in 2024 to a top priority in 2025, have led to more complex trade situations. For example, sanctions, tariffs, and investment screening have made some insurance companies more cautious about providing coverage in certain regions or for certain types of cargo. In areas with high geopolitical risks, like the Middle East and South China Sea, it may be more difficult for businesses to find insurers willing to offer comprehensive marine cargo insurance policies.

Pro Tip: Businesses should start looking for insurance providers well in advance and maintain good relationships with multiple insurers. This can increase the chances of finding available insurance coverage when needed.

Cost

Political risks also drive up the cost of marine cargo insurance. Increased cyberattacks on maritime systems, as well as stricter environmental regulations, have led to rising premiums. For instance, cyber insurance for supply chain digitalization risks has seen rising premiums as digital infrastructures in shipping are increasingly targeted. Moreover, hull and machinery insurance in geopolitical hotspots has also become more expensive due to the higher probability of damage caused by extreme weather events and other risks.

Case Study: A shipping company operating in the Middle East had to pay a significantly higher premium for their hull and machinery insurance in 2025 compared to the previous year. This was due to the increased geopolitical tensions in the region, which made insurers perceive a higher risk of damage to the vessels.

As recommended by industry experts, businesses should regularly review their insurance policies and compare quotes from different insurers to ensure they are getting the best value for their money.

Impact of Political Risks and Insurance Changes on Valuation

The changes in political risks and insurance policies directly affect business interruption valuation. When insurance availability decreases and costs increase, businesses may face higher financial losses in the event of a business interruption. For example, if a shipping company cannot obtain sufficient marine cargo insurance due to political risks, and their cargo is damaged or lost during transit, they will have to bear a larger portion of the losses themselves. This, in turn, will have a negative impact on their business interruption valuation, as they may have to incur additional costs to replace the lost cargo and compensate for the delay in delivery.

Risk Assessment Factors

Scope of Business Interruption Insurance Cover

Assessing the scope of business interruption insurance cover is crucial for accurate valuation. A comprehensive policy should cover various aspects such as operational disruptions caused by digital failures (including blockchain breakdowns or cyberattacks on digital supply chain systems), pandemic – related costs (such as crew medical expenses, repatriation, and quarantine measures), and damage due to extreme weather events.

Key Takeaways:

- Political risks in 2025 have a significant impact on the availability and cost of marine cargo insurance.

- Changes in political risks and insurance policies directly affect business interruption valuation.

- Businesses should pay close attention to the scope of their business interruption insurance cover to ensure accurate valuation.

Try our business interruption valuation calculator to get a better understanding of your potential losses in case of an interruption.

FAQ

What is All – Risk Coverage in marine cargo insurance?

According to industry practices, All – Risk Coverage in marine cargo insurance is a comprehensive policy. It acts as a safety net, covering all potential risks unless explicitly excluded. For example, it can compensate for losses due to rough seas or theft. Detailed in our Types of Marine Cargo Insurance analysis, businesses shipping high – value items often opt for this.

How to choose the right marine cargo insurance based on shipping methods?

When choosing marine cargo insurance according to shipping methods, first identify specific risks. For container shipping, risks like damage during loading/unloading should be covered. For bulk shipping, spoilage risks are key. Work closely with your insurance provider, as recommended, to ensure all risks are addressed. Detailed in our Shipping Methods section.

Steps for assessing political risks for business interruption valuation?

- Monitor global political trends that could affect insurance availability and cost, such as geoeconomic confrontations.

- Review historical data on political events in relevant regions.

- Evaluate the scope of business interruption insurance cover.

As stated in risk assessment guidelines, these steps help in accurate valuation. Detailed in our Risk Assessment Factors analysis.

Marine Cargo Insurance vs Hull Insurance: What’s the difference?

Unlike hull insurance, which protects the vessel itself, marine cargo insurance focuses on the goods being transported. For example, if a vessel has a mechanical failure but the cargo is intact, hull insurance covers the ship’s repair, while marine cargo insurance only applies if the cargo is affected. Detailed in our Insurance Comparison section.