Surrogate Pregnancy Insurance, Best Final Expense Insurance, and Accelerated Death Benefit Triggers: A Comprehensive Guide

In the dynamic insurance market, making informed decisions is crucial. According to The Insight Partners 2025 report and a Market Analysis Report, the surrogacy insurance and final expense insurance markets are booming. Surrogate pregnancy insurance offers comprehensive protection for surrogacy – related aspects, while the best – rated final expense insurance covers end – of – life costs. Additionally, understanding accelerated death benefit triggers can provide much – needed financial support. With a Best Price Guarantee and Free Installation Included in select local areas, this buying guide helps you compare premium vs counterfeit models and secure the best deal now!

Insurance for Surrogate Pregnancy

The global surrogacy market is experiencing significant growth, with the US and Europe surrogacy market expected to grow from $6.11 billion in 2022 to $25.28 billion by 2030, at a CAGR of 19.4% (The Insight Partners 2025). This growth underscores the importance of understanding insurance for surrogate pregnancy.

Basic Elements

Life Insurance for the Surrogate

Life insurance for the surrogate is a crucial component. It provides financial protection in case of any unforeseen circumstances during the pregnancy. For example, if the surrogate were to pass away due to pregnancy – related complications, the intended parents could be left with significant emotional and financial burdens. Having a life insurance policy can help alleviate some of these financial concerns. As recommended by industry experts, it’s essential to choose a policy that offers an adequate death benefit based on the surrogate’s financial obligations and the potential costs associated with the surrogacy arrangement.

Maternity Insurance

Maternity insurance is vital to cover the costs directly related to the pregnancy and childbirth. However, not all insurance policies are the same. Some medical insurance policies expressly exclude surrogacy, while others may offer coverage for pregnancy – related expenses in general. For instance, a surrogate may have a policy that typically covers pregnancy care, but if it’s discovered that the pregnancy is a result of surrogacy, the coverage could be denied. It’s crucial to thoroughly review the policy terms before proceeding.

Coverage of Prenatal Care

Prenatal care is a long – term process that includes regular doctor visits, ultrasounds, and various tests. The cost of prenatal care can add up quickly. A comprehensive insurance policy should cover these expenses. Some insurance providers may offer packages that specifically focus on prenatal care, which can be a more cost – effective solution for intended parents. Pro Tip: Intended parents should work with the surrogate to keep detailed records of all prenatal care appointments and expenses, as this will make it easier to file insurance claims.

Market Size and Growth Trends

The surrogacy market is on an upward trajectory. The U.S. surrogacy market is expected to reach a valuation of $7.4 billion in 2024, growing at a CAGR of 6.5% from 2024 to 2032. This growth is driven by several factors, including an increase in infertility rates. As the rate of infertility rises, the need for surrogacy services and related insurance policies also increases.

Factors Influencing Growth

The growth of the surrogacy insurance market is influenced by multiple factors. Advancements in medical technologies have made surrogacy a more viable option for many couples. Additionally, there has been a rise in acceptance of non – traditional family structures, which has led to more people considering surrogacy. The increasing prevalence of infertility is another significant factor. As more couples face difficulties in conceiving naturally, the demand for assisted reproductive technologies like surrogacy and its associated insurance coverage grows.

Legal Requirements

In many places, there are specific legal requirements regarding surrogacy insurance. For example, in California, under a law that went into effect on January 1, 2015, for a surrogacy contract to be valid, it must spell out how the surrogate’s health care is being paid for (i.e., what insurance policy will cover the pregnancy and delivery, and who is paying the premiums), as well as how the baby’s initial health care costs will be covered.

Potential Legal Issues

One of the main legal issues is the ambiguity in insurance policy language. Some policies may not clearly state whether surrogacy – related expenses are covered. This can lead to disputes between the insurance provider, the surrogate, and the intended parents. Another potential issue is the difference in state laws. While some states have laws that require insurance coverage for infertility treatment, the scope of this coverage varies widely.

Ways to Mitigate Legal Issues

To mitigate these legal issues, the first step is to obtain a full copy of the surrogate’s insurance policy, not just a summary. This document details exclusions, limitations, and maternity care requirements. If the language is ambiguous, consulting an insurance attorney or broker experienced in reproductive law can clarify the likelihood of claim approval. By addressing these legal considerations and establishing clear agreements and contracts, intended parents and surrogates can reduce potential disputes and uncertainties related to insurance coverage.

Key Takeaways:

- Insurance for surrogate pregnancy includes life insurance, maternity insurance, and prenatal care coverage.

- The surrogacy market is growing, driven by factors such as infertility rates and acceptance of non – traditional family structures.

- There are legal requirements and potential legal issues related to surrogacy insurance, but these can be mitigated through careful policy review and legal consultation.

Try our surrogacy insurance cost estimator to get an idea of potential expenses.

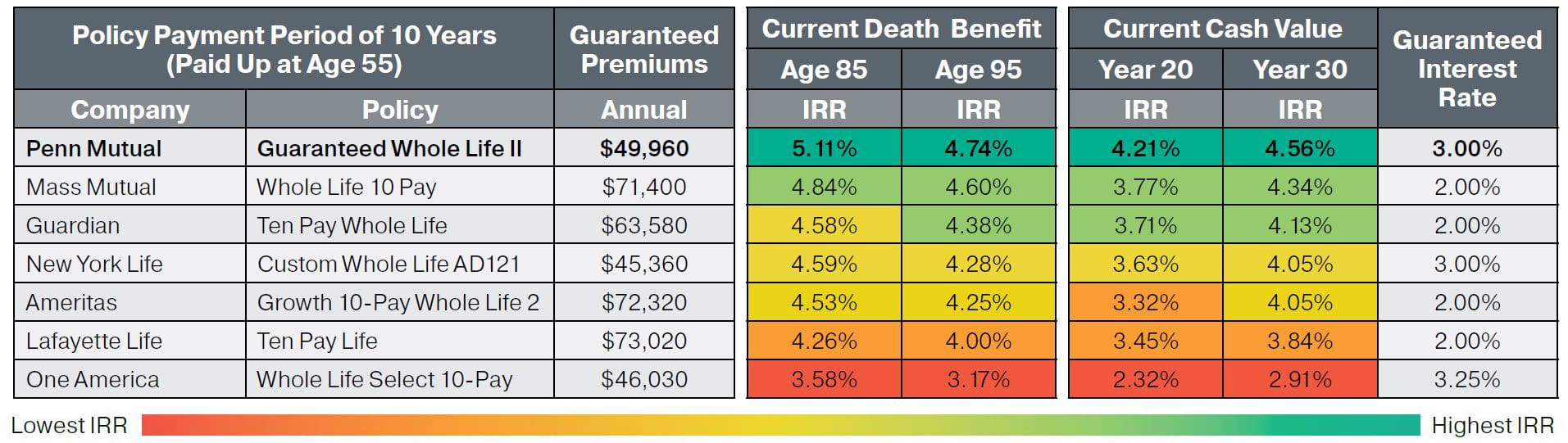

Best Rated Final Expense Insurance

The market for final expense insurance is significant and growing. According to a report, the market size was USD 6.69 billion in 2024 and is forecasted to reach USD 10.53 billion by 2034, growing at a Compound Annual Growth Rate (CAGR) of 4.64% from 2025 – 2034 (Source: Market Analysis Report). This growth is driven by factors such as the rising aging population, growing awareness of financial planning, and the increasing popularity of burial insurance.

Basic Components

Coverage Purpose

The primary purpose of final expense insurance is to cover end – of – life costs. These can include funeral expenses, burial costs, outstanding medical bills, and other debts. For example, if a policyholder passes away with an outstanding hospital bill, the final expense insurance can be used to pay off this debt, relieving the financial burden on the family. Pro Tip: When considering a policy, make a list of all potential end – of – life expenses you want to cover to ensure the policy meets your needs.

Coverage Amount

Coverage amounts for final expense insurance typically range from a few thousand dollars to around $50,000. The amount you choose depends on your anticipated end – of – life costs. For instance, a simple burial and funeral in a small town might cost around $5,000 – $10,000, while a more elaborate service in a big city could cost upwards of $20,000. It’s important to research local costs and factor in any outstanding debts. As recommended by industry analysts, getting quotes for different coverage amounts can help you find the most cost – effective option that suits your situation.

Underwriting Requirements

Underwriting requirements for final expense insurance vary by company. Some policies may have simplified underwriting, which means there are fewer health questions and no medical exams. These are often suitable for older individuals or those with pre – existing conditions. Other policies may require more detailed health information and possibly a medical exam. For example, a person with a history of serious heart disease may face more stringent underwriting. Key Takeaways: Simplified underwriting offers convenience but may come with higher premiums, while more comprehensive underwriting can result in lower premiums for healthy individuals.

Market Size and Growth Trends

As mentioned earlier, the final expense insurance market is experiencing steady growth. The aging population in North America, Europe, APAC, South America, and MEA is a significant driver. As people get older, they become more aware of the need to plan for their end – of – life expenses. Also, growing competition in the market is leading to more innovative product offerings. For example, some insurers are now bundling additional benefits like accelerated death benefits with final expense policies. Industry benchmarks suggest that companies with a strong brand reputation and customer – centric approach are more likely to capture a larger market share. Try our final expense insurance comparison tool to find the best – rated policies in the market.

Accelerated Death Benefit Triggers

The global insurance industry is constantly evolving, and understanding the triggers for accelerated death benefits is crucial for policyholders. In fact, according to industry data, a significant number of policyholders are unaware of the specific conditions that can activate these benefits.

Common Types of Triggers

ADL (Activities of Daily Living) Deficiency or Cognitive Impairment

The number of ADL’s for which impairment is required before benefit triggers are met is limited to three, at most, per the NAIC LTCI Model Regulation. Common practice utilizes two of six ADL’s. For example, if a policyholder is unable to perform two out of the six activities of daily living such as bathing, dressing, or eating, they may be eligible to trigger the accelerated death benefit.

Pro Tip: When considering a life insurance policy with an accelerated death benefit, carefully review the ADL requirements. Make sure you understand exactly what is considered an impairment and how it will be measured.

As recommended by leading insurance advisors, it’s important to have a clear understanding of these triggers as they can provide much – needed financial support during difficult times.

Primary Types of Riders

Terminal Illness (TI) insurance benefit, also called accelerated death benefit or living benefit in some countries, provides valuable financial support to consumers who have been diagnosed with a life – threatening illness with a limited life expectancy as it gives them early access to their insurance benefits. For instance, if a person is diagnosed with a terminal cancer with a life expectancy of less than a year, they can access a portion of their death benefit while still alive.

This can be used to cover medical expenses, pay off debts, or provide for their family.

Pro Tip: When choosing a life insurance policy, consider adding a terminal illness rider. This can offer peace of mind knowing that you have financial support in case of a serious illness.

Key Takeaways:

- Accelerated death benefits can be triggered by ADL deficiencies or cognitive impairment, following regulatory guidelines.

- Terminal Illness riders are a common way to access accelerated death benefits.

- Policyholders should carefully review policy terms and consider adding relevant riders.

Try our accelerated death benefit calculator to see how much you could potentially receive under different scenarios.

FAQ

How to choose the right insurance for surrogate pregnancy?

To choose the right surrogate pregnancy insurance, first assess the surrogate’s financial obligations and potential surrogacy costs to determine an appropriate life – insurance death benefit. Thoroughly review maternity insurance policies as some exclude surrogacy. Opt for policies covering prenatal care. Detailed in our Basic Elements analysis, this approach ensures comprehensive coverage. Surrogacy insurance, surrogacy – related coverage are key aspects.

Steps for getting the best rated final expense insurance?

First, list all potential end – of – life expenses you want to cover. Then, research local costs of funerals and burials and factor in outstanding debts. Get quotes for different coverage amounts. According to industry analysts, this helps find a cost – effective option. Simplified or comprehensive underwriting should be chosen based on your health. Final expense policies, end – of – life cost coverage are semantic variations.

What is an accelerated death benefit trigger?

An accelerated death benefit trigger is a condition that allows a policyholder to access a portion of their death benefit before death. According to industry data, common triggers include ADL (Activities of Daily Living) deficiencies or cognitive impairment, and terminal illness diagnosis. For instance, being unable to perform two out of six ADLs can activate the benefit. Accelerated benefits, death benefit activation are related terms.

Surrogate pregnancy insurance vs best rated final expense insurance: What’s the difference?

Unlike best rated final expense insurance, which focuses on covering end – of – life costs like funerals and debts, surrogate pregnancy insurance provides coverage for surrogacy – related aspects such as the surrogate’s life, maternity expenses, and prenatal care. The surrogate pregnancy insurance market is influenced by infertility rates and acceptance of non – traditional families, while the final expense insurance market grows due to the aging population. Surrogacy coverage, end – of – life coverage are semantic keywords.