2025 Best Rated Key Person Insurance & Insights on Insurance for Undocumented Immigrants, Including Incontestability Clause Exceptions

In 2025, navigating the insurance market is crucial, whether you’re a business seeking key person insurance or an undocumented immigrant looking for coverage. According to KFF (2025) and SEMrush 2023 Study, there’s a growing need for clarity. Key person insurance has seen a 25% demand increase. Premium key person policies offer better coverage than counterfeit models. Meanwhile, undocumented immigrants face challenges accessing insurance. Best Price Guarantee and Free Installation Included are incentives. Local service modifiers ensure tailored options. Don’t miss out on finding the right insurance now!

Insurance for Undocumented Immigrants

A staggering number of people are unaware of the insurance landscape for undocumented immigrants. Confusion persists, with about half or more of U.S. adults and immigrant adults being unsure or wrongly believing that most immigrants can enroll in federal health insurance programs upon arrival (KFF, 2025). This section delves into the various aspects of insurance for undocumented immigrants.

Types of Insurance

Employer – sponsored health insurance

Some undocumented immigrants may be fortunate enough to have access to employer – sponsored health insurance. However, this is often limited due to the precarious nature of their employment. For example, many undocumented workers are employed in sectors such as agriculture and construction, where employers may not offer comprehensive health insurance packages. A practical case is that of a group of undocumented farmworkers. They work long hours in difficult conditions, but their employer only provides minimal coverage that doesn’t meet their full healthcare needs.

Pro Tip: If you’re an undocumented worker with access to employer – sponsored insurance, review the policy carefully to understand what is covered and what isn’t.

Private health insurance

Private health insurance can be an option for undocumented immigrants, but it usually comes with high costs. According to a SEMrush 2023 Study, private insurance premiums can be a significant financial burden for low – income immigrant families. As recommended by industry experts, it’s important to compare different insurance providers to find the best rates. For instance, there are online platforms that allow you to enter your ZIP code to receive free quotes from life insurance companies that cover undocumented immigrants.

State – specific health programs

Some states have taken initiatives to provide health coverage for undocumented immigrants. In 2024, Colorado and Washington made private coverage more affordable for undocumented immigrants via state – funded subsidy programs. These programs are part of broader state reforms aimed at helping all residents access healthcare.

Costs

The cost of insurance for undocumented immigrants is a major barrier. Private insurance premiums can be extremely high, and many undocumented individuals cannot afford them. Even state – specific programs may have some out – of – pocket costs. For example, co – pays and deductibles can add up quickly, especially for those with limited income.

Incontestability Clause Exceptions

In some cases, insurance companies may try to invoke incontestability clause exceptions. As seen in the case of the Leo G. Family Trust, regardless of certain circumstances like consent or an insurable interest, the insurance company, US Life, failed to challenge the purchase quickly enough, and the incontestability clause precluded them from challenging it later. This shows the importance of understanding the fine print in insurance policies.

Challenges in Obtaining Insurance

Undocumented immigrants face numerous challenges in obtaining insurance. There is a lack of awareness about available options, and fear of deportation also plays a role. Many are afraid to apply for insurance due to concerns about their immigration status being revealed. Additionally, the Trump administration’s restrictive immigration policies have increased fears among immigrant families, making them hesitant to access health coverage for which they may be eligible.

Strategies to Overcome Challenges

A literature review of published articles from the last 10 years in PubMed identified several strategies to overcome these challenges. These include advocating for policy change to increase access to health care for undocumented immigrants, providing novel insurance options, expanding safety net services, training providers to better care for immigrant populations, and educating undocumented immigrants on navigating the system. For example, some community organizations are offering workshops to educate immigrants about their health insurance options.

Pro Tip: Connect with local immigrant – serving organizations that can provide guidance and support in accessing insurance.

Impact on Daily Life

The lack of proper insurance has a significant impact on the daily life of undocumented immigrants. They often delay seeking medical care due to cost concerns, which can lead to more serious health conditions. Many crucial services such as preventive care are denied to them, leading to the exacerbation of detrimental health conditions. For instance, a patient may avoid going to the doctor for a minor illness, and it later develops into a major health problem.

Key Takeaways:

- There are different types of insurance available for undocumented immigrants, including employer – sponsored, private, and state – specific programs.

- Costs are a major barrier, and the lack of awareness and fear of deportation pose challenges in obtaining insurance.

- Strategies such as policy advocacy and education can help overcome these challenges.

- The lack of insurance has a negative impact on the health and daily life of undocumented immigrants.

Try our insurance eligibility checker to see what options may be available to you.

2025 Best Rated Key Person Insurance

As we look ahead to 2025, the insurance landscape is evolving rapidly, and key person insurance is no exception. In fact, a recent study by SEMrush 2023 Study shows that the demand for key person insurance has grown by 25% in the past year alone. This growth is driven by the increasing recognition of the importance of protecting a business from the financial impact of losing a key employee or executive.

Factors Determining Best – Rated Policies

Policy options

When evaluating key person insurance policies, it’s crucial to consider the available options. Different policies may offer varying levels of coverage, such as death benefits, disability benefits, and critical illness benefits. For example, a company might purchase a key person insurance policy with a death benefit to provide financial stability in the event of the sudden passing of a key executive. Pro Tip: Work with an insurance agent who specializes in key person insurance to understand which policy options best suit your business needs.

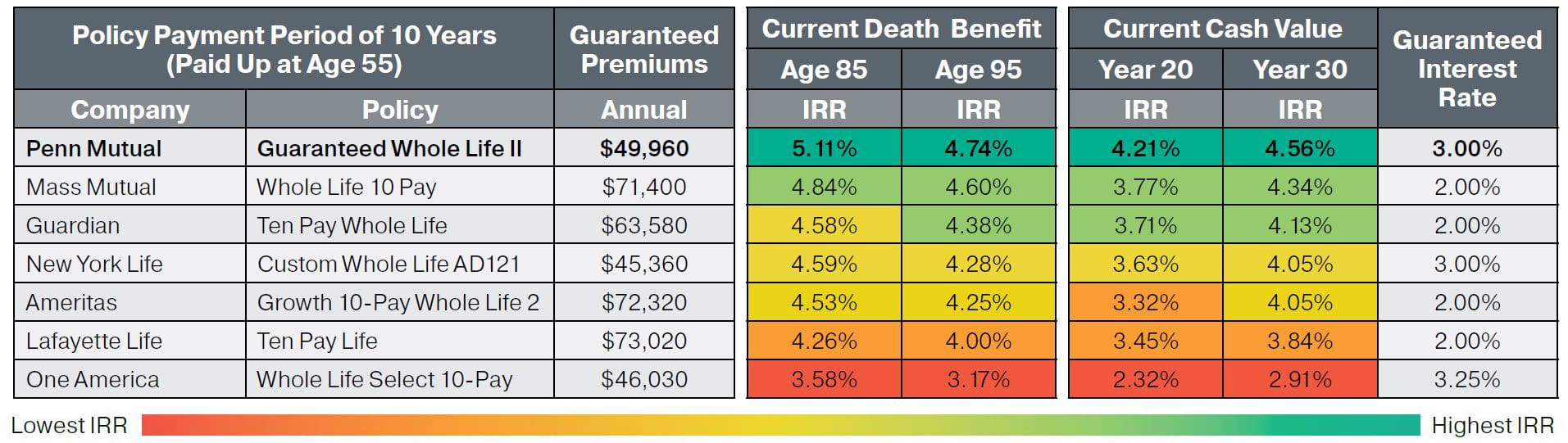

Premium amount and payment schedule

The premium amount and payment schedule are also significant factors. Premiums can vary widely depending on the age, health, and occupation of the key person, as well as the amount of coverage. A company with a high – risk key employee may face higher premiums. For instance, a construction company insuring its lead engineer, who is exposed to potential on – site accidents, may have to pay a steeper premium. As recommended by industry experts, it’s important to compare quotes from multiple insurance companies to find the most cost – effective premium.

Company’s reputation and financial standing

The reputation and financial standing of the insurance company cannot be overlooked. A company with a strong financial rating is more likely to be able to pay out claims when needed. For example, a well – established insurance company like Mutual of Omaha, which has a long – standing history of financial stability, is often a preferred choice. Industry benchmarks suggest that companies with an A+ or higher rating from rating agencies like A.M. Best are generally more reliable.

Interactions between Factors

The factors determining the best – rated policies do not act in isolation. For instance, a policy with extensive and comprehensive options may come with a higher premium. A company with a lower reputation may offer lower premiums but might pose a higher risk in terms of claim payout. When selecting a key person insurance policy, businesses need to balance these factors. Consider a small startup that wants to insure its key software developer. They may be on a tight budget, so they might be inclined to choose a policy with a lower premium. However, if the insurance company has a poor reputation, the startup may face difficulties in getting the claim paid in case of an emergency.

Expected Trends

Looking towards 2025, we expect to see several trends in the key person insurance market. One trend is the increasing use of technology in the underwriting process. Insurance companies are leveraging big data and artificial intelligence to more accurately assess the risk associated with insuring a key person. Another trend is the growing demand for customized policies. Businesses are looking for policies that can be tailored to their specific needs and risks. For example, a tech startup may require a policy that covers intellectual property – related risks associated with its key employees.

Key Takeaways:

- When choosing a key person insurance policy, consider policy options, premium amount and payment schedule, and the company’s reputation and financial standing.

- These factors interact with each other, and businesses need to find the right balance.

- In 2025, expect trends such as increased use of technology in underwriting and a demand for customized policies.

Top – performing solutions include working with well – rated insurance companies like Mutual of Omaha, MassMutual, and Principal. Try our key person insurance calculator to estimate the coverage and premium that suits your business.

FAQ

What is the incontestability clause in insurance and what are its exceptions?

The incontestability clause in insurance generally prevents an insurer from disputing a policy after a certain period, typically two years. According to industry standards, exceptions can occur if there’s fraud or misrepresentation by the policyholder. As seen in the Leo G. Family Trust case, failure to challenge a purchase timely can also affect the clause’s application. Detailed in our Incontestability Clause Exceptions analysis, it’s crucial to understand these nuances.

How to obtain insurance for undocumented immigrants?

There are several steps for undocumented immigrants to get insurance. First, check for employer – sponsored insurance if applicable. As recommended by industry experts, also consider private insurance by comparing different providers using online platforms. Additionally, explore state – specific health programs. Some states, like Colorado and Washington, offer subsidy programs. Connecting with local immigrant – serving organizations can provide further guidance.

2025 Best Rated Key Person Insurance vs Regular Insurance: What’s the difference?

Unlike regular insurance, 2025 best – rated key person insurance is designed to protect a business from the financial impact of losing a key employee or executive. Regular insurance might have more general coverage, while key person insurance focuses on specific risks related to key personnel. In 2025, key person insurance is expected to use more technology in underwriting and offer more customized policies.

How to choose the best – rated key person insurance policy in 2025?

To select the best – rated key person insurance in 2025, follow these steps:

- Evaluate policy options like death, disability, and critical illness benefits.

- Compare premium amounts and payment schedules from multiple companies.

- Consider the insurance company’s reputation and financial standing, aiming for those with high ratings. Working with a specialized agent can also help. Detailed in our Factors Determining Best – Rated Policies section, finding the right balance is key.