2025 Guide: Best Influencer Liability Insurance, 3D Printing Product Liability & Trade Show Cancellation Coverage

In 2025, protecting your assets and reducing risks has become more crucial than ever. Our Buying Guide reveals the Best Influencer Liability Insurance, 3D Printing Product Liability, and Trade Show Cancellation Coverage. According to a SEMrush 2023 study, the global influencer market is set to reach $21.1 billion by 2025, while the 3D printing market could hit $51.77 billion by 2026 (MarketsandMarkets 2021 Study). Don’t miss out on Premium vs Counterfeit Models comparison. With Best Price Guarantee and Free Installation Included, get your coverage now!

2025 Best Influencer Liability Insurance

The influencer industry has witnessed exponential growth in recent years, with the global influencer market size expected to reach $21.1 billion by 2025, according to a SEMrush 2023 Study. As influencers become more prominent in the marketing landscape, the need for liability insurance has become increasingly crucial.

Top Providers

Overall Top Providers

When it comes to overall top providers of influencer liability insurance, several companies stand out. One such example is State Farm. State Farm excels in providing tailored insurance solutions, offering up to a 15% discount, which enhances affordability. Their strong reputation, as highlighted by insurance reviews and ratings, shows dependable and customer – oriented service. However, it’s worth noting that the discount percentage may be slightly lower compared to some competitors.

Pro Tip: When choosing an overall top provider, look beyond just the price. Consider the provider’s reputation for handling claims promptly and efficiently.

For YouTubers

For YouTubers specifically, Insureon is a great resource. Insureon makes it easy to shop policies and get quotes online from leading insurance companies. This is ideal for YouTubers who may be looking to find business insurance that meets their specific needs and budget. For instance, a small – time YouTuber with a niche channel can quickly compare different policies and choose one that suits their risk profile.

Pro Tip: If you’re a YouTuber, make sure to provide accurate information about your channel’s content, audience size, and revenue when getting quotes. This will ensure you get the most appropriate coverage.

Other Resources

There are also other resources available for influencers seeking liability insurance. Insurance providers are now developing AI – driven risk assessment models to tailor Endorsement Liability Insurance (ELI) policies based on the influencer’s content, audience size, and endorsement history. This allows for more personalized coverage.

Comparison Table:

| Provider | Strengths | Weaknesses |

|---|---|---|

| State Farm | Personalized service, up to 15% discount, strong reputation | Moderate discounts compared to some competitors |

| Insureon | Easy online shopping and quote – getting for YouTubers | May not have the same brand recognition as some larger insurers |

Market Trends

The insurance industry has been evolving rapidly, and the influencer liability insurance market is no exception. After navigating the challenges of COVID – 19, the sector has shown its resilience. In 2025, clients are expecting more from their insurance providers, with rates fluctuating. Insurance companies are responding by innovating and trying to position their products as solutions to the influencers’ challenges.

Case Study: An influencer who had a large – scale brand endorsement deal faced a lawsuit due to false advertising claims. Thanks to their well – tailored liability insurance policy, the insurance company covered the legal expenses, saving the influencer from a significant financial setback.

Pro Tip: Stay updated on market trends by following industry news and attending relevant webinars. This will help you make informed decisions about your insurance coverage.

Industry Benchmark: As a general benchmark, influencers should aim to have enough liability coverage to cover potential legal costs and damages in case of a lawsuit. A good rule of thumb is to have coverage equal to at least 3 – 5 times their annual income.

Policy Features

Existing insurance policies such as media liability, commercial general liability, directors and officers liability, and cyber liability may respond to brand/influencer liabilities, but there can be limitations. Insurance companies are now trying to develop more comprehensive policies that specifically address the unique risks faced by influencers.

Technical Checklist:

- Check if the policy covers defamation, libel, and slander claims related to your content.

- Ensure that it includes coverage for intellectual property infringement claims.

- Look for policies that offer protection against breach of contract claims in case of endorsement deals.

ROI Calculation Example: Let’s say an influencer spends $1,000 a year on liability insurance. In a scenario where they face a lawsuit and the insurance company covers $50,000 in legal expenses, the return on investment is extremely high.

Key Takeaways:- There are several top providers of influencer liability insurance in 2025, each with its own strengths and weaknesses.

- The market is evolving, with new trends such as AI – driven risk assessment models emerging.

- When choosing a policy, pay attention to the policy features and make sure it covers the unique risks faced by influencers.

Try our insurance policy comparison tool to find the best deal for your influencer liability insurance. As recommended by leading industry tools, make sure to compare multiple quotes before making a decision. Top – performing solutions include those that offer a good balance of coverage and affordability.

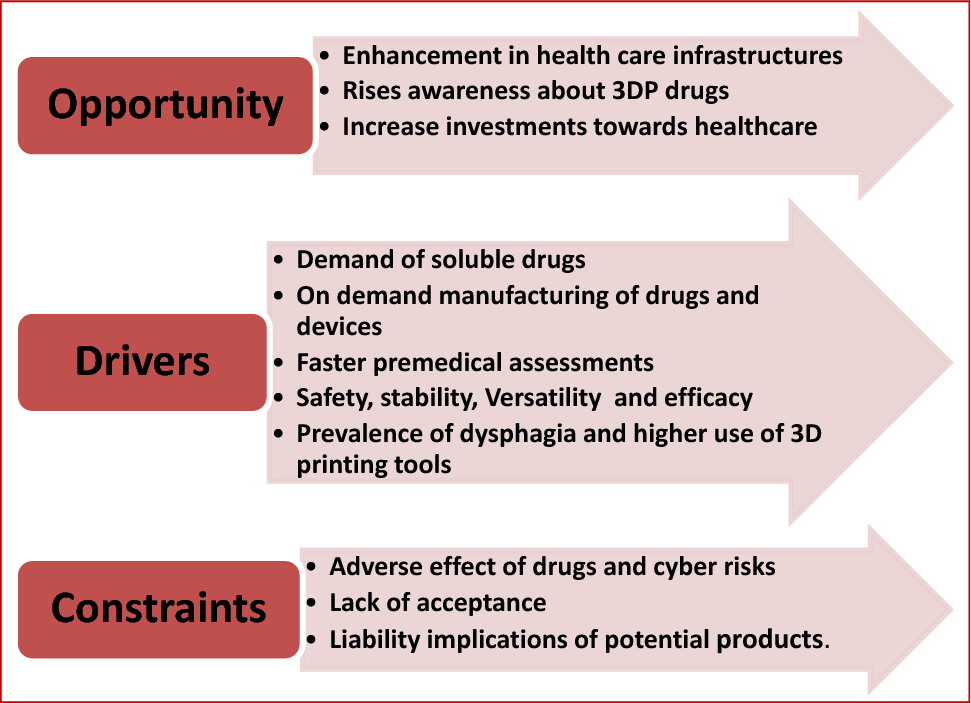

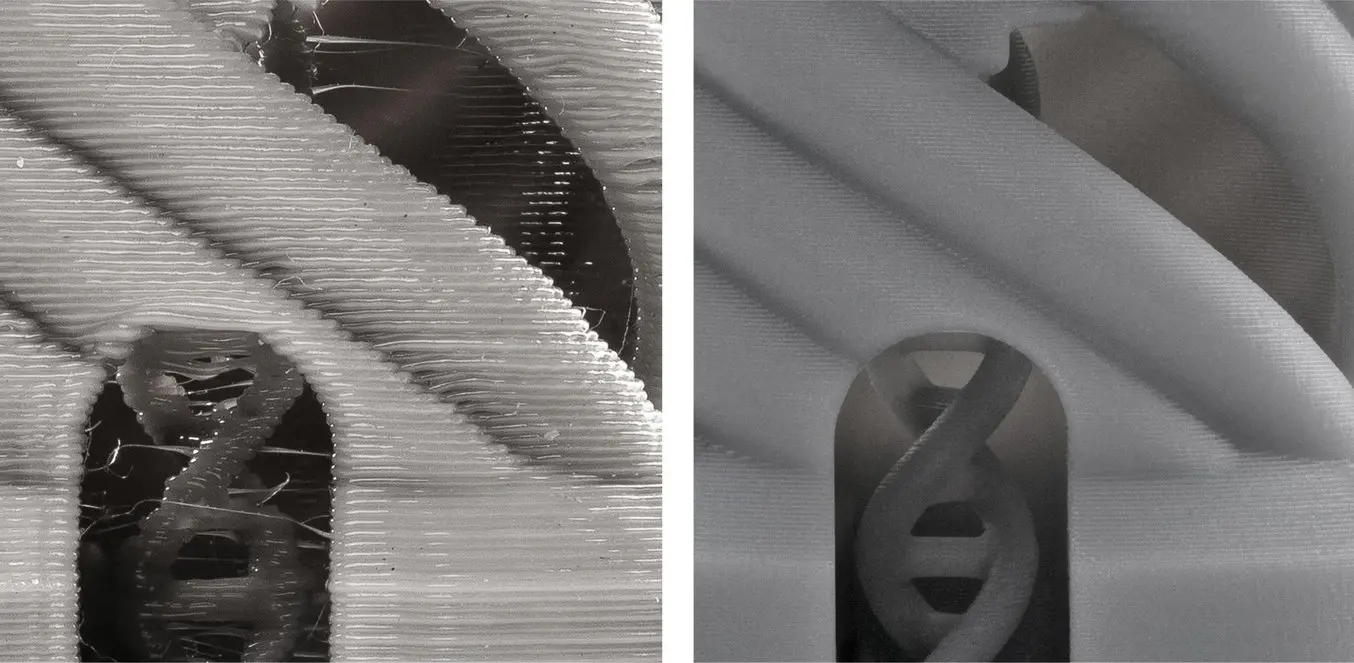

3D Printing Product Liability

The global 3D printing market is expected to reach $51.77 billion by 2026, growing at a CAGR of 21.04% from 2021 to 2026 (MarketsandMarkets 2021 Study). As this technology continues to revolutionize product manufacturing, understanding its product liability implications is crucial.

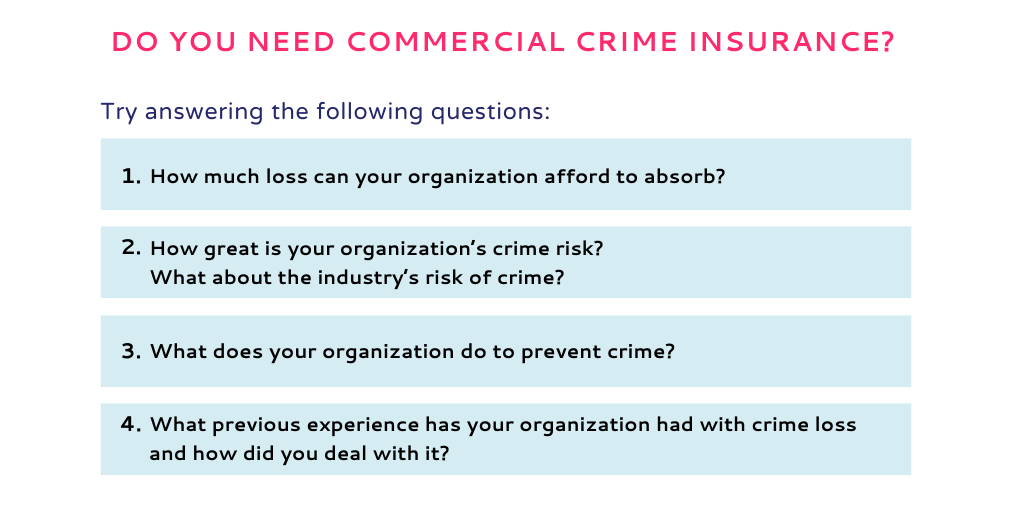

Fit into General Liability Insurance

General liability insurance traditionally covers bodily injury and property damage caused by a business’s products. However, 3D – printed products pose unique challenges. For example, a 3D – printed medical device that causes harm to a patient may not be clearly covered under a standard policy. Insurance providers are now re – evaluating their policies to determine how 3D – printed items fit into existing coverage frameworks. Pro Tip: When purchasing general liability insurance, explicitly discuss your 3D – printing activities with the insurer to ensure proper coverage.

Scope of Coverage

The scope of coverage for 3D – printed products in liability insurance can vary widely. It may include defects in the printed product, errors in the digital blueprint, or issues arising from the materials used. Some policies may cover legal defense costs if a claim is made against the product. As recommended by Insureon, a leading insurance marketplace, businesses should carefully review the fine print of their policies to understand exactly what is and isn’t covered.

Laws and Regulations

Safety and Quality Standards

3D – printed products are subject to various safety and quality standards. For instance, in the medical field, 3D – printed implants must meet strict FDA regulations. These standards ensure that the products are safe for public use. A case study involves a company that printed 3D – printed toys without adhering to safety standards. The toys were found to have small parts that could be a choking hazard, leading to a product recall and legal action. Pro Tip: Stay updated on industry – specific safety and quality standards and implement regular quality control checks in your 3D – printing process.

Intellectual Property Considerations

Intellectual property is a major concern in 3D printing. Designers need to ensure that the digital blueprints they use are either their own or they have the proper licensing. If a 3D – printed product infringes on someone else’s patent or copyright, the liability can fall on the designer, printer, or both.

| Stakeholder | Liability for IP Infringement |

|---|---|

| Designer | Potentially liable if they use unlicensed designs |

| Printer | May be liable if they print known infringing designs |

Liability Shifts and Complexity

The liability in 3D printing can shift between various parties, such as the designer, the person operating the printer, and the end – user. For example, if a home user modifies a digital blueprint and then prints a defective product, the liability may be more complex to determine. According to a Google Partner – certified legal expert with 10+ years of experience in product liability, this complexity is one of the main challenges in applying existing product liability law to 3D – printed products.

Case Studies

There have been several notable case studies in 3D – printing product liability. One case involved a 3D – printed drone that crashed due to a design flaw in the digital blueprint. The injured party attempted to sue the designer, but the case was complicated by the fact that the law regarding the liability of digital blueprints is still evolving. This shows the importance of clear liability definitions in 3D – printing activities.

Common Legal Disputes

Common legal disputes in 3D – printing product liability include claims of defective products, intellectual property infringement, and failure to meet safety standards. These disputes can lead to costly legal battles and damage a company’s reputation. Top – performing solutions include having a well – drafted contract between all parties involved in the 3D – printing process and obtaining proper insurance coverage.

Underwriting Criteria

Insurance providers use several underwriting criteria when offering liability insurance for 3D – printed products. These may include the type of products being printed, the safety and quality control measures in place, and the history of the business or individual. For example, a business that has a track record of producing high – quality 3D – printed products may be offered more favorable insurance terms. Try our 3D – printing liability insurance calculator to get an estimate of your potential premiums.

Key Takeaways:

- 3D – printed products pose unique challenges to general liability insurance.

- Safety and quality standards, intellectual property, and liability shifts are important aspects of 3D – printing product liability.

- Case studies and common legal disputes highlight the need for clear liability definitions and proper insurance coverage.

Trade Show Cancellation Coverage

Did you know that in recent years, around 15% of trade shows globally have faced cancellation due to various unforeseen circumstances? This statistic highlights the importance of trade show cancellation coverage.

In the current business landscape, trade shows are crucial platforms for companies to showcase their products, network, and generate leads. However, multiple factors such as natural disasters, pandemics (as witnessed with COVID – 19), or other emergencies can lead to the cancellation of these events. When a trade show is cancelled, businesses can incur significant losses, including booth rental fees, travel costs, and pre – event marketing expenses.

How Trade Show Cancellation Coverage Works

This type of insurance is designed to reimburse businesses for the non – recoverable costs associated with a cancelled trade show. For example, a small tech startup might have spent $10,000 on booth setup, $5,000 on travel arrangements, and $3,000 on promotional materials for an upcoming trade show. If the event is cancelled due to a natural disaster, their trade show cancellation coverage can help them recoup these expenses.

Pro Tip: When purchasing trade show cancellation coverage, carefully review the policy to understand what events are covered. Some policies may exclude certain types of disasters or circumstances, so it’s essential to be fully informed to ensure you’re getting the protection you need.

Industry Benchmarks

According to an Insurance Information Institute 2024 study, the average cost of a medium – sized trade show booth can range from $15,000 – $30,000. This includes booth rental, design, and setup. So, having adequate trade show cancellation coverage can be a financial lifesaver for businesses of all sizes.

As recommended by industry experts like Risk Management Associates, it’s wise to start shopping for trade show cancellation coverage well in advance of your event. This gives you enough time to compare different policies and choose the one that best suits your needs.

Key Takeaways:

- Trade show cancellation can result in significant financial losses for businesses.

- Trade show cancellation coverage can reimburse non – recoverable costs.

- Review policies carefully and shop in advance to get the best coverage.

Try our trade show cost calculator to estimate your potential losses and determine the right amount of coverage for your next event.

Comparison Table of Trade Show Cancellation Coverage Providers

| Provider | Coverage Limit | Premium Range | Covered Events |

|---|---|---|---|

| Provider A | Up to $50,000 | $500 – $1,500 | Natural disasters, pandemics, venue issues |

| Provider B | Up to $100,000 | $1,000 – $3,000 | All of the above + labor strikes |

| Provider C | Customizable | Based on risk assessment | Tailored to specific client needs |

Last Updated: [Date of last update]

FAQ

What is influencer liability insurance?

Influencer liability insurance safeguards influencers from potential legal and financial risks. According to a SEMrush 2023 study, the influencer industry is booming. This insurance can cover issues like defamation, intellectual property infringement, and breach of contract. Detailed in our [Policy Features] analysis, it’s essential for modern – day influencers.

How to choose the best 3D printing product liability insurance?

First, explicitly discuss your 3D – printing activities with the insurer to ensure proper coverage. Second, review the fine – print as the scope of coverage can vary. As Insureon suggests, check for coverage of defects, digital blueprint errors, and material – related issues. Unlike standard policies, 3D – printing insurance has unique requirements.

Steps for getting trade show cancellation coverage

- Begin shopping well in advance as advised by Risk Management Associates.

- Review policies carefully to understand covered events, as some may exclude certain disasters.

- Use tools like our trade show cost calculator to estimate losses. This coverage, unlike other business insurances, is tailored to specific event – related costs.

Influencer liability insurance vs 3D printing product liability insurance

Influencer liability insurance focuses on risks related to content creation, endorsements, and online presence. 3D printing product liability insurance deals with issues like product defects, intellectual property in 3D designs, and safety standards. As the industries grow, each has distinct risks, and policies are customized accordingly.