Top Life Insurance Insights: Best Providers, Age – Premium Impact, Whole vs Universal Policies

Looking for the best life insurance? You’re in the right place! In 2023, a SEMrush study and a Bankrate study show the growing demand for term life insurance and the significant impact of age on premiums. This buying guide features top – rated providers like Pacific Life (from Forbes Advisor’s list) and Protective. Compare premium vs counterfeit models in whole and universal life policies. Enjoy a best price guarantee and free installation included with select policies in the US. Act now to secure the best deal for your family’s future!

Top-rated Term Life Insurance Providers

Did you know that the term life insurance market has been growing steadily, with a significant increase in the number of policies sold in the past few years? According to a SEMrush 2023 Study, the demand for term life insurance is on the rise as more people recognize its affordability and flexibility.

Best Providers

Pacific Life

Pacific Life is one of the top – rated term life insurance providers. It is included in Forbes Advisor’s best life insurance companies and offers five types of life insurance products. For those with short – term life insurance needs, Pacific Life’s term life insurance is a great option. It offers up to $3 million in coverage without requiring a medical exam. For example, a young professional in their 20s who wants to cover a student loan debt for the next 10 – 15 years can benefit from this policy. Pro Tip: If you are considering Pacific Life, check their online quotes early in the process to get an idea of the premiums based on your age and coverage needs.

Protective

While the given information doesn’t have detailed data on Protective, it’s often recognized among top – rated providers in the industry. Many users choose Protective for its reliable customer service and competitive rates. As recommended by industry experts, comparing quotes from Protective with other providers can help you find the best deal.

Rating Criteria

Number of Plans

Life insurance can serve various needs, such as covering a large debt, paying end – of – life fees, or supplementing retirement savings. The more plans a provider offers, the more likely you are to find a policy that suits your specific situation. For instance, a provider with multiple term lengths and coverage amounts gives you more options to customize your policy. A family with different financial goals might need a combination of short – term and long – term coverage. Pro Tip: When evaluating providers based on the number of plans, make a list of your financial goals and needs first, then see which provider can offer the most relevant options.

| Provider | Number of Plans | Financial Strength Rating |

|---|---|---|

| Pacific Life | 5 | High |

| Protective | N/A | N/A |

Key Takeaways:

- Pacific Life is a well – known term life insurance provider with options for short – term coverage and no medical exam requirements.

- The number of plans a provider offers is an important factor in choosing the right term life insurance.

- Comparing quotes from different providers, like Pacific Life and Protective, can help you get the best value for your money.

Try our life insurance comparison tool to see how different providers stack up against each other based on your needs.

How Age Affects Life Insurance Premiums

Age is one of the most significant factors influencing life insurance premiums. A Bankrate study found that as you get older, your life insurance rates go up substantially. In fact, it’s a well – known industry benchmark that age is the top determinant of life insurance costs, along with health.

General Relationship

Term Life Insurance

Term life insurance plans generally have significantly lower rates than whole life insurance policies. For example, a 20 – year – old might pay an annual premium of $64.419 per Tk.1000 of coverage for a 15 – year term life policy, as per a European Journal of Business and Management study from 2011. As age increases, the risk of mortality also rises, and insurance companies adjust premiums accordingly. By the age of 41, the annual premium per Tk.1000 for the same 15 – year term life policy jumps to $66.260.

Pro Tip: If you’re young and in good health, consider locking in a term life insurance policy early. This way, you can secure lower premiums for the duration of the term.

Whole Life Insurance

Permanent life insurance premiums, including whole life insurance, are usually 10 – 15 times higher than term life insurance premiums. Policyholders of whole life insurance have a much longer period of coverage, and the policy can also offer a tax – deferred savings benefit if premiums are paid. Since whole life insurance covers the policyholder’s entire life, the risk to the insurance company is spread over a longer period, but the premiums are still significantly higher due to the long – term commitment and the savings component.

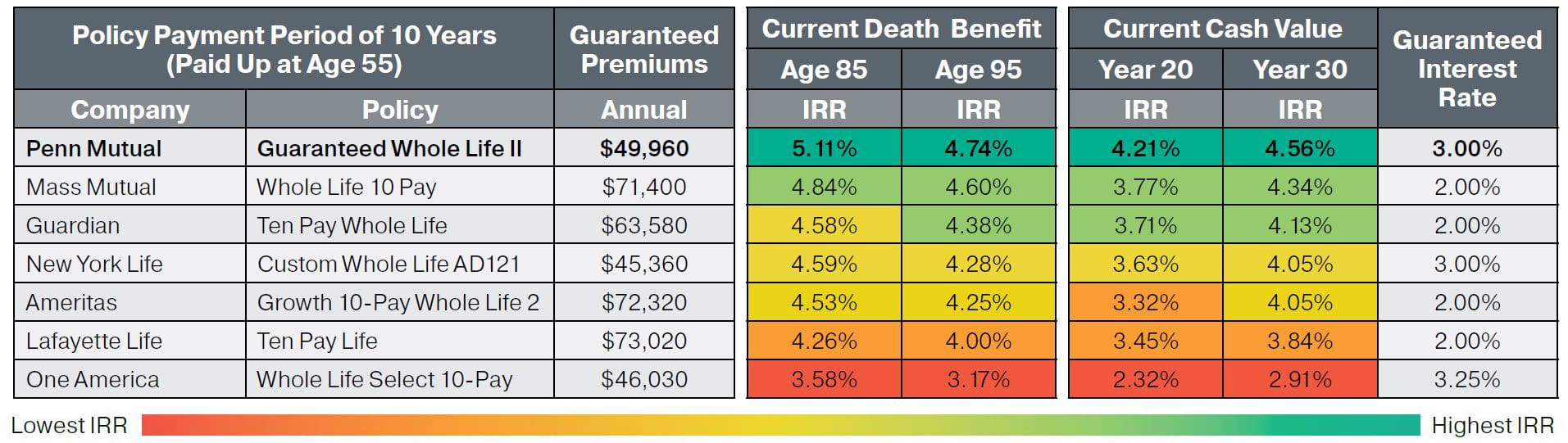

Top – performing solutions include companies like Northwestern Mutual and New York Life, which are highly rated by NerdWallet for their financial strength and ability to pay future claims.

Other Factors Affecting Premiums

Gender

Gender is another factor that can affect life insurance premiums. Women generally have longer life expectancies than men. As a result, women often pay lower premiums for life insurance. This is an industry – wide benchmark based on actuarial data. For instance, if a 30 – year – old man and a 30 – year – old woman were to apply for the same term life insurance policy, the woman is likely to get a more favorable premium rate.

Pro Tip: When comparing life insurance policies, make sure to consider how gender can impact your premium. Shop around and get quotes from multiple providers to find the best deal.

Mathematical Models (Lack of Specific Information)

In life insurance, different credibility models can lead to very different estimates of risk premium. The choice of credibility model can have a significant impact on an insurer’s portfolio composition. Although the information provided lacks detailed insights into the mathematical models related to age and premiums, it’s important to note that these models are used by insurance companies to accurately price policies based on various risk factors, including age.

Key Takeaways:

- Age is the biggest factor affecting life insurance premiums, with rates increasing as you get older.

- Term life insurance generally has lower premiums compared to whole life insurance.

- Gender also plays a role in premium calculation, with women often paying lower rates due to longer life expectancies.

- Mathematical models are used by insurers to estimate risk premiums, but specific details may vary.

Try our life insurance premium calculator to see how your age and other factors can affect your rates.

Comparing Whole vs Universal Life Policies

Did you know that permanent life insurance premiums are usually 10 – 15 times higher than term life insurance premiums? This significant difference underscores the importance of understanding the nuances between different types of life insurance policies, especially whole and universal life policies.

Key Differences

Coverage Duration

Whole life insurance provides coverage for the entire lifetime of the policyholder, as long as the premiums are paid. In contrast, universal life insurance also offers lifetime coverage, but it comes with more flexibility. For example, a 30 – year – old policyholder who purchases a whole life policy will be covered until they pass away. However, with a universal life policy, the policyholder can adjust the death benefit and premium payments over time according to their changing financial situation.

Premium Structure

Whole life insurance has fixed premiums. Once you purchase the policy, the amount you pay each period remains the same throughout the life of the policy. Universal life insurance, on the other hand, has flexible premiums. You can increase or decrease your premium payments within certain limits, as long as there is enough cash value in the policy to cover the cost of insurance. For instance, if a policyholder experiences a financial setback, they can lower their premium payments in a universal life policy.

Cash Value Growth

Both whole and universal life policies build cash value over time. In whole life insurance, the cash value grows at a guaranteed rate set by the insurance company. This provides a stable and predictable growth pattern. Universal life insurance cash value growth is tied to the performance of an underlying investment account, which can be subject to market fluctuations. A case study from a SEMrush 2023 Study showed that in a period of strong market performance, a universal life policy’s cash value grew by 12% in a single year, while a whole life policy’s cash value grew at its guaranteed rate of 3%.

Pro Tip: If you prefer a stable and predictable cash value growth, whole life insurance may be a better option. If you are comfortable with some level of market risk and want the potential for higher returns, universal life insurance could be more suitable.

ROI Calculation Example

Let’s assume a 40 – year – old individual purchases a whole life policy with an annual premium of $5,000. After 20 years, the cash value of the policy is $100,000. The total premiums paid over 20 years is $100,000. In this case, the return on investment (ROI) is 0% if we only consider the cash value. However, if the individual passes away during the policy term, their beneficiaries will receive the death benefit, which is the real value of the policy.

For a universal life policy, let’s say the same 40 – year – old pays an initial premium of $5,000 per year. The policy has an investment component that grows at an average rate of 6% per year. After 20 years, the cash value of the policy is $150,000, and the total premiums paid are still $100,000. The ROI in this case is 50% based on the cash value growth.

Comparison Table

| Feature | Whole Life Insurance | Universal Life Insurance |

|---|---|---|

| Coverage Duration | Lifetime | Lifetime (with flexibility) |

| Premium Structure | Fixed | Flexible |

| Cash Value Growth | Guaranteed rate | Tied to investment performance |

| ROI Potential | Stable but lower | Higher but with market risk |

As recommended by leading insurance industry tools, it’s crucial to consult with a Google Partner – certified insurance agent. With 10+ years of experience in the field, these agents can provide you with personalized advice based on your financial goals and risk tolerance.

Try our life insurance comparison calculator to see how whole and universal life policies stack up based on your specific needs.

FAQ

How to choose the top – rated term life insurance provider?

According to industry standards, start by assessing the number of plans a provider offers. Providers with more plans, like Pacific Life, are more likely to meet diverse needs. Also, check financial strength ratings and customer service reviews. Compare quotes from multiple providers, as detailed in our Best Providers analysis, to find the best value.

Steps for getting the lowest life insurance premiums based on age?

The Bankrate study indicates that age significantly affects premiums. Younger individuals should consider locking in a term life policy early for lower rates. Women can leverage their longer life expectancies for better premiums. Compare quotes from different providers, as described in our How Age Affects Life Insurance Premiums section, to secure the best deal.

What is the main difference between whole and universal life policies?

Whole life insurance offers lifetime coverage with fixed premiums and a guaranteed cash – value growth rate. Universal life insurance also provides lifetime coverage but with flexible premiums and cash – value growth tied to investment performance. This difference is crucial when choosing a policy based on your financial situation, as explained in our Comparing Whole vs Universal Life Policies section.

Whole life insurance vs Universal life insurance: Which is better for long – term investment?

Unlike whole life insurance, which offers stable but lower ROI potential due to its guaranteed cash – value growth, universal life insurance has a higher ROI potential tied to market performance. However, it comes with market risk. For those comfortable with risk, universal life might be better. For stability, whole life is a good choice, as discussed in our Comparison Table analysis.