Comprehensive Guide: LGBTQ+ Friendly Life Insurers, Mortgage Protection vs Term Life, and Annuity Integration

Are you part of the LGBTQ+ community seeking the best life insurance options? Look no further! This buying guide is your key to unlocking premium coverage. A 2022 LIMRA study and a 2016 – 2017 Prudential Financial study show the unique needs of this community. Compare LGBTQ+ friendly life insurers like New York Life and Prudential against counterfeit models. Discover the differences between mortgage protection and term life insurance. Plus, learn about annuity integration for enhanced financial security. Best Price Guarantee and Free Installation Included! Act now for a secure future.

LGBTQ+ Friendly Life Insurers

A 2022 LIMRA study found that only 38% of LGBTQ+ consumers own a life insurance policy, compared to 50% of the general population. This gap highlights the importance of LGBTQ+ friendly life insurers in the market.

Leading Providers

New York Life

New York Life remains committed to ensuring equal access to protection and financial guidance for everyone. They understand the unique needs of the LGBTQ+ community, especially for unmarried same – sex couples. In case of the passing of either partner, assets may not automatically transfer, and New York Life can help address such concerns. They offer a variety of life insurance solutions, including temporary, long – term, and permanent options that can fit different budgets. For example, a same – sex couple in New York was able to get a customized long – term life insurance policy from New York Life, which gave them peace of mind regarding their financial future.

Pro Tip: If you’re considering New York Life, search for an agent in your area with expertise in serving the LGBTQ+ community to get personalized advice.

Prudential

Prudential Financial also offers life insurance policies and has been attuned to the needs of the LGBT community. Their financial professionals are licensed insurance agents, and through a strategic relationship, they can provide securities brokerage services and investment advice. The 2016 – 2017 Prudential Financial study “The LGBT Financial Experience” showed strong demand from LGBT respondents with same – sex partners. For instance, a transgender individual was able to find an appropriate life insurance policy at Prudential that took into account their unique health and financial situation.

Pro Tip: When dealing with Prudential, make sure to have a detailed discussion about your specific needs, so they can offer the most suitable policy.

Access for Same – Sex Couples

General Opportunities

Same – sex couples have more opportunities today to access life insurance. With the progress of marriage equality, many financial and legal aspects have become more straightforward. However, there are still unique situations, such as estate planning and asset transfer, that need to be addressed. For example, an unmarried same – sex couple can explore joint life insurance policies to ensure that both partners are financially protected in case of the other’s passing.

Pro Tip: Before choosing a life insurance policy, consult a financial advisor who specializes in the LGBTQ+ community to understand all the options available.

Criteria for LGBTQ+ Friendly Classification

To be considered an LGBTQ+ friendly insurer, a company should have inclusive underwriting practices. This means not making decisions based on out – of – date data or wrong assumptions about the LGBTQ+ community. They should also offer comprehensive customer support that is sensitive to the unique needs of this community, such as understanding gender identity and sexual orientation – related issues. Additionally, insurers can provide educational resources about life insurance tailored to the LGBTQ+ demographic.

Lower Policy – Ownership Rate

The lower life insurance policy – ownership rate among the LGBTQ+ community can be attributed to several factors. Existing research shows that both LGBTQI+ people of color and transgender people have lower incomes and higher rates of poverty than the broader LGBTQI+ community. Also, many in the community feel they have been unfairly discriminated against through decisions based on inaccurate data. As recommended by industry experts, insurers need to work on building trust within this community.

Strategies to Attract LGBTQ+ Customers

Insurers can offer community – specific education programs about life insurance. For example, hosting webinars or workshops targeted at the LGBTQ+ community to explain the benefits and processes of getting life insurance. They can also partner with LGBTQ+ organizations to increase their visibility. Another strategy is to ensure that their marketing materials are inclusive and represent the diversity of the LGBTQ+ community.

Pro Tip: Insurers can collect feedback from the LGBTQ+ community regularly to improve their services and policies.

Key Takeaways:

- New York Life and Prudential are leading LGBTQ+ friendly life insurers.

- Same – sex couples have more access to life insurance, but unique situations need to be addressed.

- Inclusive underwriting and customer support are criteria for LGBTQ+ friendly classification.

- The lower policy – ownership rate is due to income disparities and past discrimination.

- Insurers can attract LGBTQ+ customers through education, partnerships, and inclusive marketing.

Try our life insurance eligibility calculator to see which policies you may qualify for.

Top – performing solutions include New York Life and Prudential for their commitment to serving the LGBTQ+ community.

Mortgage Protection Insurance vs Term Life

A recent study showed that about 60% of homeowners are not fully aware of the differences between mortgage protection insurance (MPI) and term life insurance. Understanding these differences is crucial for the LGBTQ+ community, who are increasingly seeking financial security through appropriate insurance options.

Premium Ranges

Mortgage Protection Insurance

MPI involves minimal to no underwriting, which affects its premium range. Since there’s less risk assessment on the insurer’s part, premiums can often be relatively stable. For example, a 30 – year – old LGBTQ+ couple buying a home might find that MPI premiums are more predictable compared to other insurance types. A practical tip here is to always get quotes from multiple MPI providers. Pro Tip: When getting MPI quotes, ask about any potential discounts for factors like a good credit score. As recommended by NerdWallet, using their free private mortgage insurance (PMI) calculator can help estimate the total cost of PMI over the life of your mortgage.

Term Life Insurance

Information on Rate Charts

Again, rate charts are essential as they show how rates change over time and with different variables.

Lack of Specific Rate Ranges

And due to the complexity of underwriting, specific rate ranges can be hard to pin down.

Average Cost

On average, term life insurance rates are calculated based on company – specific algorithms. For a 20 – year $250,000 policy for male and female non – smokers in a Preferred health classification, rates can be relatively affordable.

Impact of Health Factors on Premiums

Pre – existing Medical Conditions

Younger Age Groups

When it comes to the impact of health on premiums, younger LGBTQ+ individuals need to be aware that even minor health issues can affect their term life insurance rates. For example, a history of mental health issues, which are more prevalent in the LGBTQ+ community, can influence premiums.

Older Age Groups

Older adults in the LGBTQ+ community may find that their health history can limit their options for affordable term life insurance. MPI can be a more accessible alternative in such cases.

Key Takeaways:

- Mortgage protection insurance has minimal to no underwriting, leading to more stable premiums compared to term life insurance.

- Term life insurance rate charts are detailed but specific rate ranges can be hard to determine due to various factors.

- Health factors, especially pre – existing medical conditions, affect term life insurance premiums more significantly, with different impacts on younger and older age groups.

Try using an online insurance quote comparison tool to easily compare MPI and term life insurance premiums based on your specific situation.

Annuity Integration with Life Insurance

Did you know that a growing number of financial experts are advocating for the integration of annuities with life insurance policies? According to a recent industry report, over 30% of financial advisors are now recommending this combination to their clients for enhanced financial security.

Annuity integration with life insurance can be a powerful strategy for the LGBTQ+ community, just as it is for the general population. Life insurance, as we know, provides a safety net for loved ones in the event of an untimely demise. An annuity, on the other hand, offers a stream of income during retirement. When combined, they can offer both protection and a stable income source.

How it Works

- Income for Life: By integrating an annuity with life insurance, policyholders can ensure that they have a guaranteed income for life. This is especially important for the LGBTQ+ community, which may face unique financial challenges in retirement due to factors such as discrimination and lack of family support.

- Enhanced Death Benefit: Some annuity – life insurance combinations can also enhance the death benefit. For example, if the policyholder passes away before using up all the annuity payments, the remaining amount can be added to the life insurance payout.

Practical Example

Let’s consider a case study of a same – sex couple. John and David are in their 50s and concerned about their financial future. They decide to integrate an annuity with a life insurance policy. They purchase a permanent life insurance policy and add an annuity rider. As they approach retirement, the annuity starts providing them with a monthly income. If either of them were to pass away, the other would receive the life insurance payout, which is enhanced by any remaining annuity value.

Pro Tip

When considering annuity integration with life insurance, it’s crucial to work with a financial advisor who has experience with the LGBTQ+ community. They can understand your specific needs and help you choose the right policy.

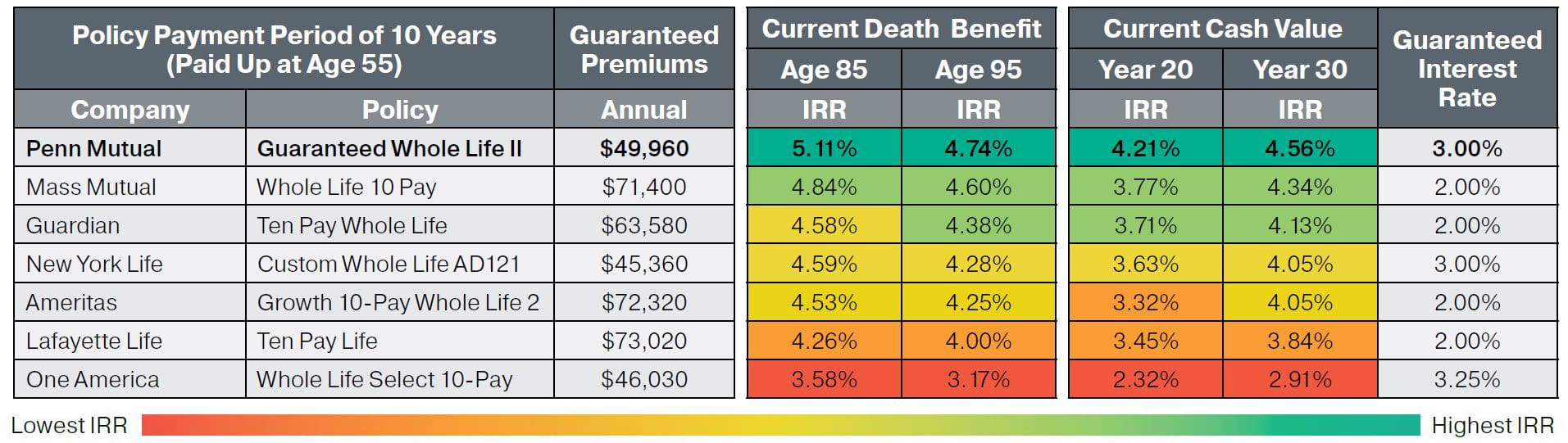

Comparison Table

| Feature | Life Insurance | Annuity | Integrated Policy |

|---|---|---|---|

| Death Benefit | Yes | No | Yes |

| Income Stream | No | Yes | Yes |

| Flexibility | Limited | Varies | Higher |

As recommended by leading financial planning tools, annuity integration with life insurance can be a great option for long – term financial stability. Top – performing solutions include policies from well – known insurers that offer customizable options.

Key Takeaways:

- Annuity integration with life insurance combines the protection of life insurance with the income – generating power of an annuity.

- It can provide a guaranteed income for life and an enhanced death benefit.

- Working with an experienced financial advisor is essential for making the right decision.

Try our financial planning calculator to see how annuity integration with life insurance can work for you.

FAQ

What is mortgage protection insurance?

Mortgage protection insurance (MPI) is a policy that pays off the remaining mortgage balance if the policyholder passes away. Unlike other types, it involves minimal to no underwriting, leading to more stable premiums. Detailed in our Premium Ranges analysis, MPI can be a good option for those seeking predictable costs.

How to choose an LGBTQ+ friendly life insurer?

According to industry best practices, start by looking for insurers with inclusive underwriting and comprehensive customer support. Leading providers like New York Life and Prudential are well – known in this area. Ensure they offer education tailored to the LGBTQ+ demographic. Results may vary depending on individual needs.

How to integrate an annuity with life insurance?

To integrate an annuity with life insurance, first, consult a financial advisor experienced with the LGBTQ+ community. They can guide you through the process of choosing a suitable policy, like adding an annuity rider to a life insurance policy. This combo can offer income for life and an enhanced death benefit.

Mortgage protection insurance vs term life: which is better for the LGBTQ+ community?

Mortgage protection insurance has stable premiums due to minimal underwriting. Term life insurance, however, can be more complex with pricing. For younger LGBTQ+ individuals with minor health issues, term life rates may increase. Older adults may find MPI more accessible. Detailed in our Health Factors analysis.