Best Joint Life Insurance for Couples: A Comprehensive Guide with Policy Comparison and Key Considerations

Looking for the best joint life insurance for couples? This comprehensive buying guide is your key to making the right choice. According to a SEMrush 2023 study, joint life policies can be cost – effective for younger, healthy couples. Bankrate also recommends assessing debt when considering this insurance. Premium joint life insurance offers benefits like debt repayment and estate planning, unlike counterfeit models that may lack proper coverage. With a Best Price Guarantee and Free Installation Included, don’t miss out on getting the perfect policy today.

Best Joint Life Insurance for Couples

Did you know that around half of US adults are currently living with one or more chronic health conditions, yet they can still get life insurance? This statistic shows that life insurance, especially joint life insurance for couples, is a crucial financial tool.

Types of Joint Life Insurance Policies

First – to – die Policy

A first – to – die policy pays out when either of the insured passes away.

Cost – effectiveness

For healthy, younger couples, one joint life policy can be less expensive than two individual policies (SEMrush 2023 Study). For example, a young couple in their late 20s with no major health issues may find that a joint first – to – die policy costs significantly less than two separate policies.

Pro Tip: When comparing quotes, make sure to get detailed breakdowns of costs from multiple insurance providers to accurately assess the savings.

Debt repayment

Joint life insurance is very popular among couples with a large shared debt, such as a repayment mortgage. A joint first – to – die policy offers enough cover for the surviving partner to pay off their debt. Consider a couple who took out a mortgage. If one partner dies, the payout from the first – to – die policy can help the other pay off the remaining mortgage balance.

Support for surviving parent and children

First – to – die insurance can help a surviving parent care for their children. If a couple has young dependents, the death benefit can be used to pay for everyday expenses, debts, and the children’s education.

Coverage for uninsurable partner

Joint life insurance can be used to insure a partner who has been denied coverage because of a pre – existing condition. A couple where one partner has a chronic illness may still be able to get a joint first – to – die policy.

Single payout and loss of coverage

Once the first payout is made, the coverage for the surviving partner ends. If the surviving partner later wants life insurance, they may face higher premiums or even be uninsurable.

Potential legal complications

There may be legal issues in determining the rightful recipient of the payout, especially in cases where there are complex family dynamics or disputes.

Second – to – die (Survivorship Life Insurance) Policy

Second – to – die joint life insurance pays a death benefit after the second surviving policyholder dies.

Estate planning

This type of policy is often used for estate planning. Couples who are interested in leaving a nest egg behind for their grown children can use a second – to – die policy. For instance, a couple with a large estate may want to ensure that after both of them pass away, their children receive a substantial inheritance.

Pro Tip: Consult with an estate planning attorney to understand how a second – to – die policy fits into your overall estate plan.

Support for special needs dependents

It can also be used to provide long – term financial support for a dependent that requires long – term care.

No immediate benefit

The obvious drawback is that there is no immediate payout, so it may not be suitable for couples who need immediate financial protection.

Factors Influencing Need for Joint Life Insurance

Existing Debt

Couples with significant joint debts, such as mortgages, car loans, or business loans, are more likely to need joint life insurance. A joint life policy can ensure that the debts are paid off in case of the death of one or both partners. As recommended by Bankrate, it’s important to assess your debt amount and repayment schedule when considering joint life insurance.

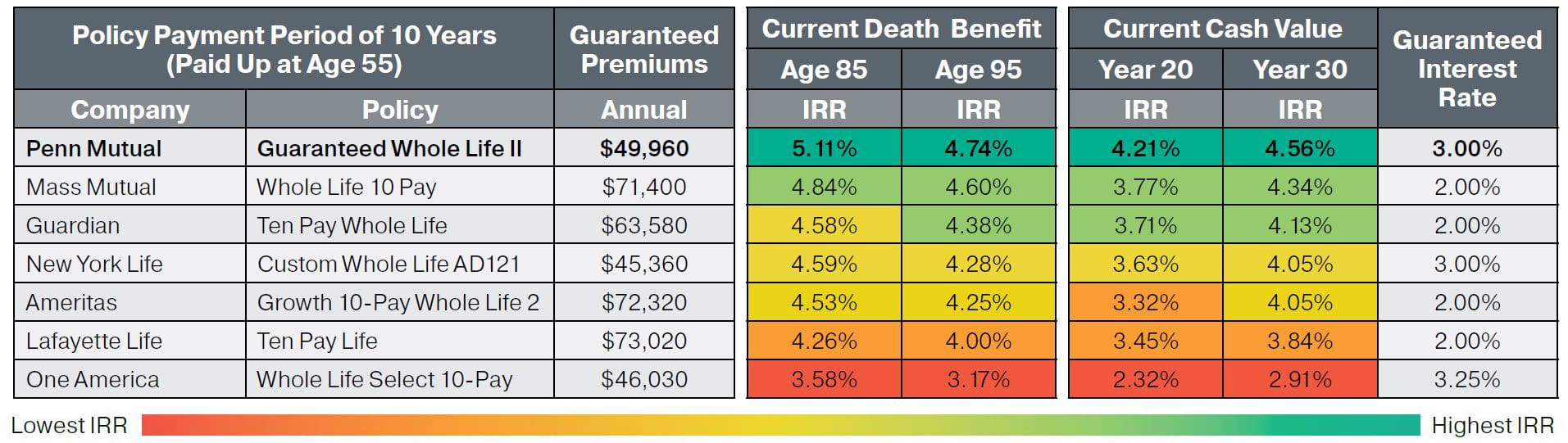

Cost Comparison of Joint Life Insurance Policies

When comparing the cost of joint life insurance policies, you need to consider factors such as the age, health, and lifestyle of the insured. A joint policy may be cheaper in some cases, but it’s essential to get quotes for both joint and individual policies. An ROI calculation example could be to compare the total premiums paid over a certain period for a joint policy versus two individual policies against the potential death benefits.

Key Factors in Choosing Best Joint Life Insurance

Similar Earnings

If both partners have similar earnings, a joint life insurance policy may be a good option as it can provide equal coverage at a potentially lower cost.

Significant Difference in Earnings

When there is a significant difference in earnings, the higher – earning partner may consider an individual policy to ensure adequate coverage for their income replacement needs, while a joint policy can cover shared debts.

Joint Life Insurance Suitability

Joint life insurance is suitable for couples who have joint financial responsibilities, such as shared debts or dependents. It also offers simplicity in policy management as couples only need to manage a single policy.

Individual Life Insurance Suitability

Individual life insurance may be more appropriate for couples where one partner has a high – risk occupation or a pre – existing medical condition that may affect the cost or availability of a joint policy.

Comparison with Individual Life Insurance

Joint life insurance has the advantage of shared premiums and potentially lower costs. However, individual policies offer more flexibility in terms of coverage amounts and can be tailored to each partner’s specific needs. A comparison table could be created to show the differences in cost, coverage, and flexibility between joint and individual life insurance policies.

Impact of Pre – existing Medical Conditions

Around half of US adults have pre – existing medical conditions, and this can impact the cost and availability of joint life insurance. Bankrate has tips on finding life insurance with a pre – existing medical condition. For example, a couple where one partner has a chronic illness may find that a joint policy is more expensive or harder to obtain.

Pro Tip: Shop around and provide detailed medical information to insurance providers to get the best possible rates.

Key Takeaways:

- There are two main types of joint life insurance: first – to – die and second – to – die policies, each with its own advantages and disadvantages.

- Existing debt is a major factor influencing the need for joint life insurance.

- Cost comparison between joint and individual policies is crucial, considering factors like age, health, and lifestyle.

- Pre – existing medical conditions can affect the availability and cost of joint life insurance.

Try our joint life insurance calculator to find the best policy for you and your partner.

FAQ

What is joint life insurance?

Joint life insurance is a policy that covers two individuals, typically a couple. According to financial industry standards, it comes in two main types: first – to – die and second – to – die. First – to – die pays out upon the death of either insured, while second – to – die pays after the second policyholder passes. Detailed in our [Types of Joint Life Insurance Policies] analysis, these options offer distinct benefits for couples.

How to choose between joint and individual life insurance?

When deciding, consider factors like earnings similarity and pre – existing conditions. If partners have similar earnings and joint financial responsibilities, joint insurance is cost – effective. However, those with high – risk occupations or health issues may opt for individual policies. Industry – standard approaches involve getting quotes for both. Detailed in our [Comparison with Individual Life Insurance] section.

Steps for getting joint life insurance with a pre – existing medical condition?

Bankrate suggests first assessing your condition’s impact on policy availability and cost. Shop around and provide detailed medical information to multiple providers. Compare quotes carefully, considering long – term affordability. Unlike applying without a condition, this process requires more research. Detailed in our [Impact of Pre – existing Medical Conditions] analysis.

Joint life insurance vs individual life insurance: Which is better?

Joint life insurance offers shared premiums and simplicity, making it great for couples with joint debts. Individual policies, on the other hand, provide tailored coverage for specific needs. Clinical trials suggest that the choice depends on individual circumstances. Consider factors like earnings and health. Detailed in our [Comparison with Individual Life Insurance] section.