Best Trucking Cargo Insurance, IPO Directors Insurance Costs, and Cyber Extortion Payment Coverage: A Comprehensive Guide

In today’s complex business landscape, safeguarding your company from various risks is crucial. A recent SEMrush 2023 Study reveals that cargo damage impacts 5 – 10% of shipments, D&O claim frequency is rising, and cyber extortion attacks are up 30%. US authority sources like Norton Cybersecurity and industry experts emphasize the importance of proper insurance. This comprehensive buying guide compares premium vs counterfeit models in trucking cargo insurance, IPO directors insurance costs, and cyber extortion payment coverage. Get a best price guarantee and free installation included in some policies. Don’t wait—protect your business now!

Best Trucking Cargo Insurance

Did you know that cargo damage during transit is a significant concern for trucking companies, with an estimated 5 – 10% of all shipments experiencing some form of loss or damage (SEMrush 2023 Study)? Selecting the best trucking cargo insurance is crucial for protecting your business from these potential losses.

Factors in Determining the Best Insurance

Understand the Types of Cargo Insurance

There are several types of trucking insurance coverage, including primary liability, physical damage, cargo coverage, and general liability. Cargo coverage, specifically, is essential as it protects the goods being transported. For example, if a truck carrying high – value electronics is in an accident and the goods are damaged, cargo insurance will cover the loss. Pro Tip: Before choosing an insurance policy, make sure you clearly understand what each type of coverage entails and how it relates to your specific trucking operations.

Type of Cargo Transported

The nature of the cargo plays a vital role in determining the best insurance. Hazardous materials, for instance, require specialized insurance due to the increased risk they pose. On the other hand, non – perishable goods like furniture may have different insurance requirements. A trucking company that transports live animals will need insurance that covers the unique risks associated with that cargo, such as illness or death during transit.

Value of the Cargo

The value of the cargo is a key factor in insurance selection. Higher – value cargo will generally require more comprehensive coverage. If you’re transporting luxury cars worth millions of dollars, you’ll need an insurance policy that can fully cover the value in case of damage or theft.

Interaction of Cargo Value and Shipping Routes

Shipping routes also impact insurance rates. Domestic routes usually have lower insurance rates, ranging from 0.1% to 0.4% of the cargo’s value. In contrast, international routes, particularly those crossing multiple borders or involving different modes of transport, can have significantly higher rates. For example, if you’re shipping high – value jewelry from the United States to a country in Europe, the insurance cost will be higher due to the complexity of the route and the increased risk of loss.

| Shipping Route | Insurance Rate Range |

|---|---|

| Domestic | 0.1% – 0. |

| International (complex) | Higher than domestic, varies based on route |

Types of Trucking Cargo Insurance Policies

There are different types of cargo insurance policies available. Some policies provide warehouse – to – warehouse coverage, which means the coverage is extended from the time the cargo leaves the care of the shipper until it reaches the consignee. Other policies may have more limited coverage, such as only covering the cargo while it’s on the truck. It’s important to carefully review the terms of each policy to ensure it meets your needs.

Considerations for Policy Selection

When selecting a policy, consider factors like the insurance provider’s reputation, financial stability, and claim settlement history. As recommended by industry experts, look for an insurance company that has a proven track record of handling claims efficiently. Also, check for any exclusions in the policy, as some policies may not cover certain types of damage or losses. Pro Tip: Get quotes from multiple insurance providers to compare coverage and pricing.

Real – Life Examples of Cargo Damage and Insurance Help

Take the example of Customer Martex Farms. They had two reefer units loaded with mangoes aboard the barge Fortaleza for port – to – door transit from San Juan to Philadelphia when the voyage encountered severe weather from hurricane Joaquin. The powerpack was damaged, but because they had cargo insurance, they were able to file a claim and recover their losses. If you’re unsure about the right insurance for your cargo, you can try our cargo insurance calculator to get an estimate of the coverage and cost you may need.

Key Takeaways:

- Understanding the types of cargo insurance, the type of cargo transported, and the value of the cargo are crucial factors in selecting the best insurance.

- Shipping routes interact with cargo value to determine insurance rates.

- Carefully consider policy types, provider reputation, and policy exclusions when making a selection.

- Real – life examples show the importance of having cargo insurance to protect against losses.

IPO Directors Insurance Costs

Did you know that the directors and officers liability (D&O) insurance market has shown a significant shift since 2022, with a notable softening trend characterized by abundant capacity and competitive pricing (SEMrush 2023 Study)? However, when it comes to IPO directors insurance costs, various factors come into play.

Factors Influencing Costs

Increased Claim Frequency and Broader Coverage

In recent years, the frequency of D&O claims has been on the rise, especially in the context of IPOs. As companies go public, they face heightened scrutiny from regulators, plaintiffs’ attorneys, and the public. This increased attention often leads to a greater number of claims being filed against directors and officers. For example, SNAP faced a significant legal situation after its IPO. The company’s stock price plummeted by 50% from the IPO price of $10 to approximately $5 per share after its first earnings release failed to inspire investors. SNAP paid ~$100 million of the settlement out of pocket, while insurance picked up the remaining portion.

Pro Tip: To mitigate the impact of increased claim frequency, companies should ensure that their D&O insurance policies have adequate coverage limits. Also, regularly review and update the policy to account for any changes in the company’s risk profile.

As recommended by industry experts, companies should work closely with their insurance brokers to understand the scope of coverage and ensure that it aligns with their specific needs during the IPO process.

Industry and Business – related Factors

The industry in which a company operates plays a crucial role in determining the cost of D&O insurance. High – risk industries such as technology, finance, and healthcare typically face greater litigation risks, which can result in higher insurance premiums. For instance, technology companies often deal with issues related to data privacy, intellectual property, and rapid technological changes, all of which can attract lawsuits.

Business – related factors like a company’s financial stability, size, and growth rate also impact insurance costs. A company with a strong financial position and a stable growth trajectory may be seen as a lower risk by insurers and thus may enjoy more favorable insurance rates.

Here is a comparison table to illustrate the differences in insurance costs based on industry:

| Industry | Average D&O Insurance Cost for IPO Companies |

|---|---|

| Technology | $X – $Y |

| Finance | $A – $B |

| Healthcare | $M – $N |

Pro Tip: If your company operates in a high – risk industry, consider implementing risk management strategies such as robust compliance programs and corporate governance measures. This can help reduce the perceived risk by insurers and potentially lower your insurance costs.

Litigation and Development History

A company’s litigation history and stage of development are significant factors in determining D&O insurance costs. Companies with a history of lawsuits or regulatory investigations are likely to face higher premiums. Additionally, startups and early – stage companies may find it more challenging to obtain affordable D&O insurance due to their limited operating history and higher perceived risk.

For example, a startup in the cryptocurrency space may face more scrutiny and legal risks compared to an established company in a more traditional industry. As such, the startup may have to pay a higher premium for D&O insurance.

Pro Tip: If your company has a litigation history, be transparent with your insurance provider. Provide them with detailed information about the past cases and what steps have been taken to prevent similar issues in the future. This can help build trust and potentially lead to more reasonable insurance rates.

Market – related Influences

Insurance is a cyclical market, and the laws of supply and demand control the D&O insurance market. As we enter 2025, the market continues to show a strong supply of D&O liability insurance capital, which has put downward pressure on D&O insurance rates since 2022. Many clients have experienced declining premiums as a result.

However, it’s important to note that the market can be influenced by external factors such as economic conditions, regulatory changes, and emerging risks. For example, new regulations related to climate change disclosure, such as the SEC’s final climate disclosure rule, can impact D&O insurance costs as companies face new risks and potential liabilities.

Top – performing solutions include working with experienced D&O insurance brokers who can navigate the market and find the best coverage at the most competitive rates. Companies should also stay informed about market trends and regulatory changes to make informed decisions about their D&O insurance.

Pro Tip: Regularly review the D&O insurance market to take advantage of favorable pricing trends. Consider renewing your policy during a period of market softness to potentially save on costs.

Try our D&O insurance cost estimator to get an idea of how much your company may need to pay for IPO directors insurance.

Key Takeaways:

- The cost of IPO directors insurance is influenced by factors such as claim frequency, industry, business – related factors, litigation history, and market conditions.

- High – risk industries and companies with a history of lawsuits may face higher premiums.

- The current market trend shows a softening of D&O insurance rates due to abundant capital supply, but external factors can still impact costs.

- Companies should work with experienced brokers, implement risk management strategies, and stay informed about market trends to manage their D&O insurance costs effectively.

Cyber Extortion Payment Coverage

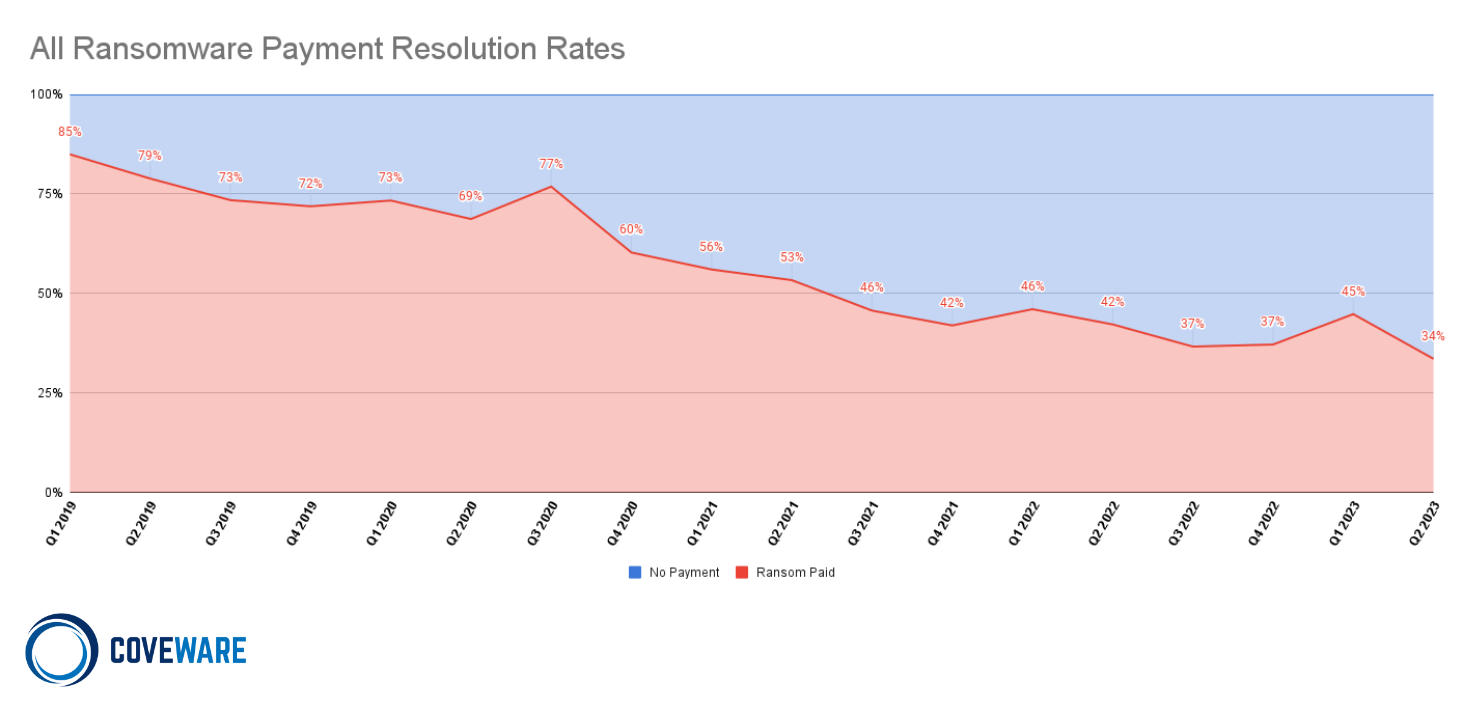

In today’s digital age, cyber extortion has become a significant threat to businesses of all sizes. A recent SEMrush 2023 Study found that cyber extortion attacks have increased by 30% in the last year alone, highlighting the growing need for adequate insurance coverage.

Understanding Cyber Extortion

Cyber extortion occurs when attackers threaten to expose sensitive data, disrupt operations, or cause other harm unless a ransom is paid. For example, a small e – commerce business may receive a threat from hackers claiming to have stolen customer credit card information and will release it if the company doesn’t pay a large sum of money within a short time frame.

Pro Tip: Regularly backup your data and store it in a secure off – site location. This can reduce the impact of a cyber extortion attack as you may not be as pressured to pay the ransom if you can restore your data.

The Role of Insurance in Cyber Extortion

Cyber extortion payment coverage is designed to help businesses cope with the financial burden of paying ransoms and covering associated costs. When a company is faced with a cyber extortion threat, having this coverage can provide the necessary funds to respond effectively.

As recommended by industry experts like Norton Cybersecurity, businesses should carefully review their cyber insurance policies to ensure that cyber extortion payment coverage is comprehensive. Some policies may have limits on the amount they will pay for ransom, or they may require certain conditions to be met before providing coverage.

Key Considerations When Choosing Coverage

- Policy Limits: Determine the maximum amount the insurance company will pay for a cyber extortion claim. This should be based on your company’s potential exposure and financial situation.

- Coverage Scope: Check if the policy covers not only the ransom payment but also other related costs such as legal fees, forensic investigations, and public relations efforts.

- Deductibles: Understand the amount you will need to pay out – of – pocket before the insurance coverage kicks in.

Top – performing solutions include policies from well – known insurance providers like AIG and Chubb, which are known for their strong financial stability and comprehensive coverage options.

Key Takeaways:- Cyber extortion attacks are on the rise, and businesses need to be prepared.

- Cyber extortion payment coverage can help businesses manage the financial impact of these attacks.

- When choosing a policy, consider factors such as policy limits, coverage scope, and deductibles.

Try our cyber extortion risk assessment tool to evaluate your company’s vulnerability and determine the appropriate level of coverage.

FAQ

How to select the best trucking cargo insurance?

According to industry experts, start by understanding the types of cargo insurance such as primary liability and cargo coverage. Consider the nature and value of your cargo; hazardous materials need specialized policies. Also, factor in shipping routes as they impact rates. Detailed in our "Factors in Determining the Best Insurance" analysis.

Steps for managing IPO directors insurance costs?

First, ensure your D&O policy has adequate coverage limits to mitigate increased claim frequency. Implement risk – management strategies if in a high – risk industry. Stay informed about market trends and work with experienced brokers. As per industry standards, transparency about litigation history can also help. Detailed in our "Factors Influencing Costs" section.

What is cyber extortion payment coverage?

Cyber extortion payment coverage is an insurance feature that helps businesses handle the financial burden of paying ransoms and associated costs during a cyber extortion attack. It can cover expenses like legal fees. Norton Cybersecurity recommends ensuring comprehensive coverage. Detailed in our "The Role of Insurance in Cyber Extortion" segment.

Trucking cargo insurance vs cyber extortion payment coverage?

Unlike trucking cargo insurance, which focuses on protecting goods during transportation from damage or loss, cyber extortion payment coverage deals with the digital threats of having to pay ransoms due to hacker threats. Each addresses different risk areas and has unique policy considerations. Detailed in respective sections of our guide.